20 Apr What is two-way matching?

Contents:

What that means is that you end up spending more time getting invoices fulfilled than you’re supposed to. With these three documents in hand, the accounts payable personnel can crosscheck to determine whether a supplier’s invoice is legitimate, before making payment. This helps avoid fraud from unwarranted and falsified invoices. Since all documents are now converted from physical to digital format, the software is able to compare and match them automatically. This is possible because of the conditions specified prior to the matching process.

PDF documents that are created electronically typically have the necessary data encoded in the PDF file. PDF files that are created by scanning are just pictures and will not have the necessary data. Not every organization follows the same procedure for document matching. While 3-way matching is considered the industry standard, some AP teams go for 2-way or 4-way matching. The main difference lies in the documents requiring confirmation before payment approval.

What is 3-way matching in accounts payable?

To counter the threat of overpaying for goods and services or paying a counterfeit invoice, you should seriously consider using automated three way matching into your accounts payable processes. By 3 way matching supporting documents, companies can detect duplicate, erroneous, or fraudulent payments to vendors. Three way matching is best performed as an automated workflow powered by AP automation solutions such as Nanonets.

- During the online invoice approval process, the invoice quantity and amount is matched to the purchase order and receiving information to ensure that tolerances are met.

- The receipt is created by the receiving department, or the employee creates the receipt.

- By avoiding manual document input, companies avoid typos and reduce the risk of omitting information; they meanwhile save hours of work that can be reinvested into more valuable tasks.

- Ordering from multiple vendors on different sites and completing several checkout processes can lead to disorganization and confusion.

- Through three-ways matching cash, embezzlement is to be controlled.

Our library of case studies, guides, and reports are available to help you become a better finance professional. Explore four primary hurdles facing finance professionals today and learn how to overcome them in our research-backed Financial Professional Census report. Establish and improve solid relationships between buyers and vendors. Create Purchase Order requisitions for goods and services to speed up the buying process. Although physical records may be traditional and accessible, there are far more disadvantages to them compared to automated solutions. An advertising agency needs 20 new laptops for their employees to use.

Drawbacks of the Manual 3-Way Matching Process

The invoice is based on the PO sent by the purchaser to the supplier. To ensure to only make payments for goods delivered and services legitimately rendered to your business. Perhaps, if Google and Facebook had some system for vetting their invoices before paying them out, they wouldn’t have fallen victims in the first place.

When calculated for several goods on a monthly basis, manual processing costs may run into six figures. Misplaced paper documents, incorrect information, and human oversight further increase the cost of manual invoice matching. The 2-way matching in the accounts payable process verifies that the information on the purchase order and invoice match. Any discrepancy in the information results in the invoice being withheld until the mismatch is resolved or rectified. 2-way, 3-way, and 4-way invoice matching processes require 3 documents, the invoice, the purchase order, and the receipt of the goods. When trying to scale for growth, manual accounts payable processes can be a major deterrent.

Thus, it maintains the product availability at warehouses, retailers, and distributors. Although 2-way matching is the default for many invoice verification processes, 3-way matching is becoming more widely adopted to save businesses from overspending on larger, non-recurring orders. Next, you will triple-check the PO and invoice using the order receipt . The receiving department should have a packing slip that specifies the cost and quantities of the items ordered. On the packing slip, the numbers should match those detailed on the original invoice and the PO. Book this 30-min live demo to make this the last time that you’ll ever have to manually key in data from invoices or receipts into ERP software.

The three way matching process

After all necessary approvals have been received, the invoice is flagged as “Ready to Pay”. A/P Procan generate a .CSV file for the completed invoices which can then be imported back into the accounting software, eliminating the need to re-key data. Whether or not this process can be implemented depends upon the particular accounting software in use and its import capabilities. Different companies choose to use various automation solutions in their day-to-day work.

Secure Act 2.0: 3 Ways You Could Save More for Retirement – Acorns

Secure Act 2.0: 3 Ways You Could Save More for Retirement.

Posted: Thu, 25 Aug 2022 07:00:00 GMT [source]

In this case, it’s the 1,000 masks, which, together, will cost $3,000 dollars. The mask vendor will provide you with a purchase order that will confirm the quantity and cost of the items or services ($3,000). In some cases, an order is completed over multiple deliveries done on different dates. For orders having multiple delivery dates, it is not possible to match the goods received against the invoice.

Businesses must ensure their accounts payable departments verify the legitimacy and accuracy of every invoice they pay. Companies use this reconciliation method to detect fraudulent invoices, embezzlement, computer glitches, or human error. The primary purpose of 3-way matching is to prevent any incorrect and fraudulent invoice or payment from happening in a company. The 3-way match helps organizations avoid AP issues by resolving any possible mismatches on bills and orders before payments are processed. That’s because the order receipts and vendor invoices are two standard documents needed for audits. Requiring these two documents before the completion of a transaction contributes to a straightforward tax process.

Here is everything you need to know about 2-way matching, including why it’s important and helpful 2-way matching examples. Determine if the agency’s purchasing department was authorized to order 1,000 cards from that vendor. A business can benefit from three-way-match processing in several ways. Here are three of the most quantifiable benefits for businesses, still unsure about the extra steps involved. When the documents are stored digitally , they become more secure and are free of the troubles of the infamous “piles” of organization that exist on desks throughout most companies.

It is worth investing in this https://1investing.in/ to make sure your business doesn’t pay for things you didn’t receive or overpay for things you did. If you set the system to do an exact match between purchase order and invoice amount, then the system going to raise an exception in the matching process. Your purchasing team should set up a quarterly cadence to review the catalogs with the suppliers to ensure that the data is correct. For example, if your buyers have to enter the data manually in the purchasing system, then it is likely that there are data entry errors. It is not impossible to implement a 3-way match process if you don’t have an integrated purchasing and invoicing system, but it is time-consuming and prone to human error. Vendors are aligned to support you with this effort and they are reviewing the invoices for matching errors and making adjustments to avoid such errors.

Purchase Orders

You can make three-way Accrual vs Deferral more efficient by excluding small-dollar and recurring invoices from the matching requirement. As your business grows and manages more inventory, you need automated controls in place to ensure company spend is accurate and compliant. The problem is that verifying the details of a purchase is still performed manually, leaving you vulnerable to errors, invoice fraud, and unauthorized spending — resulting in financial loss. Matching is a process performed for goods and services ordered through a purchase order that takes place during the online invoice approval process. Invoices are matched to purchase orders , receiving information , and inspection information as applicable.

- The companies ended up paying millions of dollars for fake invoices.

- Given below is a sample of an automated 3-way matching workflow.

- Manual 3-way matching is often time-consuming and repetitive, putting a significant burden on AP teams.

- Alternatively, a four-way match may include the comparison of contracts in the more broad source-to-pay process.

- This way, it can account for minor discrepancies that result from legitimate charges.

The 3-way match of purchase orders in SAP enables efficient data processing and invoice verification. Before we go into the working of the 3-way matching process, let us first understand the procure to pay process. The first step in the p2p process is placing the order with the supplier. The purchase order is the document containing complete information on the goods/services required along with pricing information.

This process is important for large purchases or purchases with newer vendors, but businesses may choose not to use three-way matches for small or recurring purchases. In this step, match the amount and quantity of the invoice to the purchase order. The supplier invoice has details of what was purchased and other relevant vendor contact details.

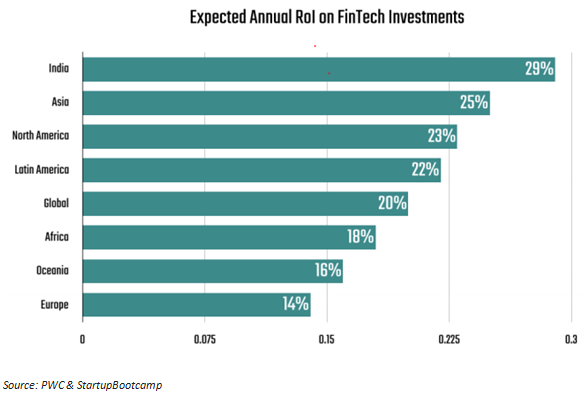

He received his bachelor’s degree in economics from the University of California, Davis, and his master’s degree in economics and finance from Bogazici University. He writes on IoT, RPA, process automation, and to jazz it up a bit, sometimes fintech. If you believe you’re ready to automate a financial process in your business, we have data-driven of FinTech solution providers. A/P Pro runs outside of the accounting software that is currently in use at a company. A/P Pro does not make any changes to the accounting software or data. The goal is to eliminate the need for A/P staff members to spend time processing transactions which match correctly.

Investing 101 For Teachers: Learn The Basics And How To Get Started – Bankrate.com

Investing 101 For Teachers: Learn The Basics And How To Get Started.

Posted: Mon, 09 May 2022 07:00:00 GMT [source]

Then, the supplier delivers ten boxes of paper accompanied by the goods receipt note. But when you receive the invoice, you notice that the supplier billed you for eleven boxes. To match the purchase order, an invoice is created on the accounts payable module. The vendor/supplier will send an invoice for the goods/services payment ordered via the purchase order. In the account payable process – the procurement and receiving stage, the 2-way, 3-way, and 4-way matching plays a vital role.

Sorry, the comment form is closed at this time.